They say that good investors do their homework. There are many important facts to consider—macro-level facts like the interest rate in the American economy, growth, labor market details, and of course, pricing trends. When we choose which market to invest in, we analyze the local data as well: expectations for housing prices, expectations for rentals, details about demand, and more.

And indeed, every few weeks, there are articles written surveying and promoting lists of the “hottest cities.” Where you can expect the biggest growth and where you might want to invest and focus.

What’s the problem with that? So actually there are a few problems in relying on the dry facts to choose a destination:

- Pygmalion Effect

It’s a well-known fact that prices and market “temperature” aren’t just a product of supply and demand but rather, also of the narrative which is created around a particular market. Increased buzz will attract entrepreneurs and investors to a particular area even before the residents themselves know that they want to live or open a business there. This phenomenon also offers an “unfair” advantage to big entrepreneurs who invest in massive projects and who can influence or create buzz in that particular area. In many situations, it’s a self-predicting prophecy: residents flock to the neighborhood which have had the most invested in them and the bet pays off. But there’s always the possibility that the process will take an extended period of time, the change will be delayed, or sometimes not even take place. Small investors will always be forced to follow the trends and not create them. This fact minimizes the risk/reward ratio, for better or for worse.

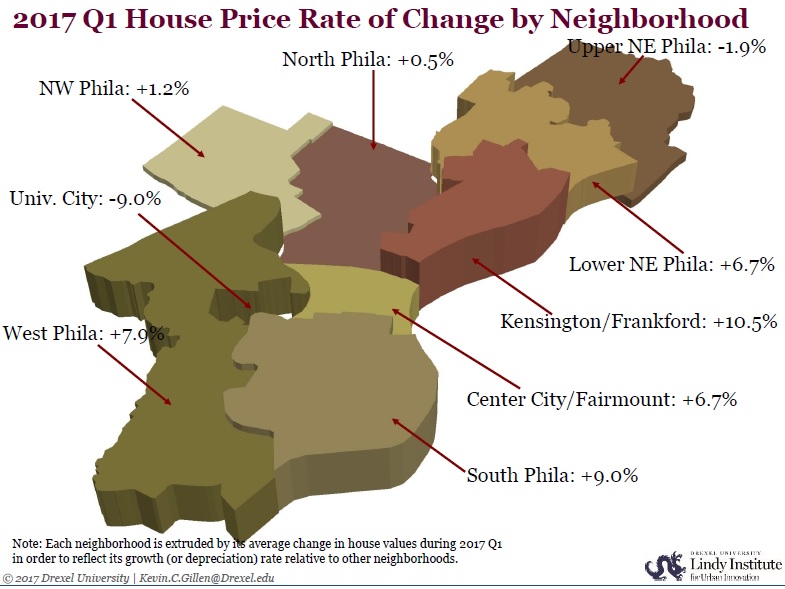

2. Neighborhood Economy

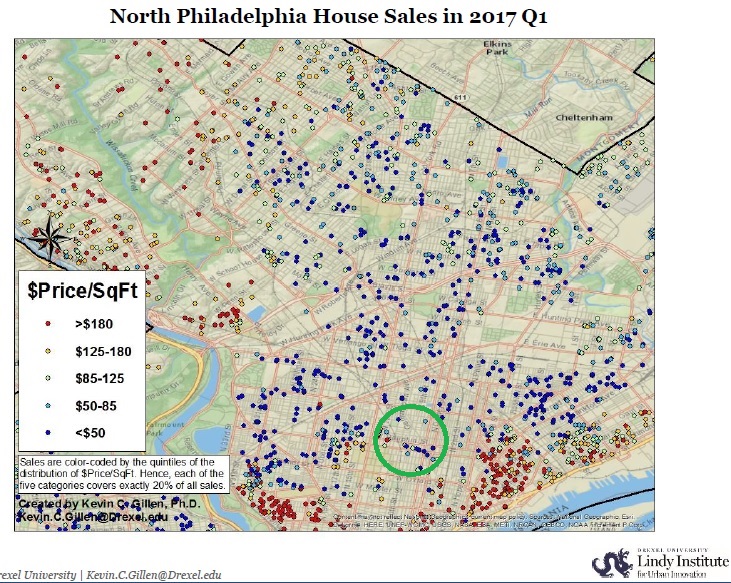

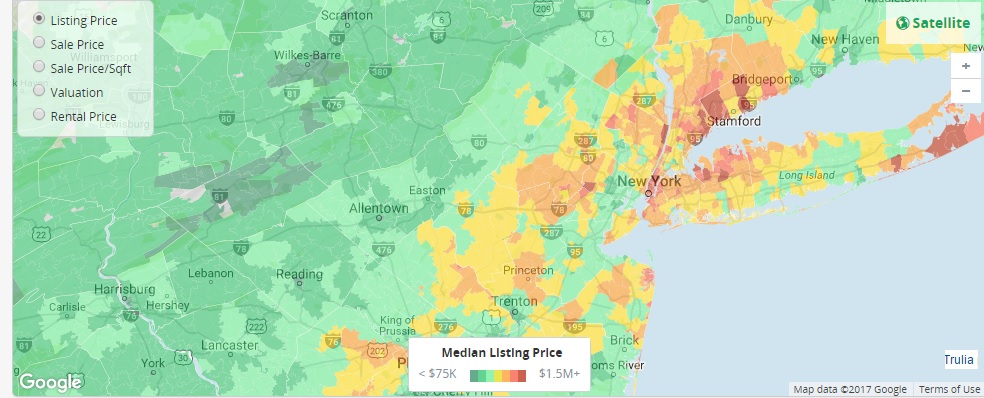

Macro-level details don’t always reflect micro processes. That means it’s possible that a particular city may experience an excellent overall numeric growth trend, but it’s also possible that the growth is concentrated in a specific area, around a number of “anchors” and doesn’t reflect the circumstances throughout the area as a whole.

3. Micro Economy

Even within neighborhoods themselves, there are trends that influence each and every street. Environmental hazards like high-tension lines or smoke from a refinery, a neighborhood drug dealer, a militant residents’ committee, all these are real-world examples that we’ve encountered in our business dealings which never appear on Zillow or Trulia, and which can turn what looks like an attractive investment on paper into something quite a bit more problematic.

So what should you do?

Here are a few iron-clad rules we’ve adopted:

- There’s no substitute for field work. Beyond just walking block by block by foot. Zero in on a property? Walk around in the area and gather information. Looking for projects currently being built? Chat with neighboring contractors or even local shopkeepers or coffee shops nearby.

- Don’t be the first or even second to buy, renovate, rent, or sell, on a particular block or street.

- Adjust the type of investment to the micro-level data and trends. That means it’s better to adjust the type of investment to the nature of the neighborhood. If we come across a neighborhood that looks good on paper, when we go out into the field, we’ll check the level of property maintenance and the level of completion of houses under renovation and adjust our investment accordingly. If it’s a blue-collar neighborhood, we might be satisfied with a reasonable level of renovation only, for the purposes of renting a property out. If it’s an investment in an area catering to spoiled students, we might invest in a higher level of construction.