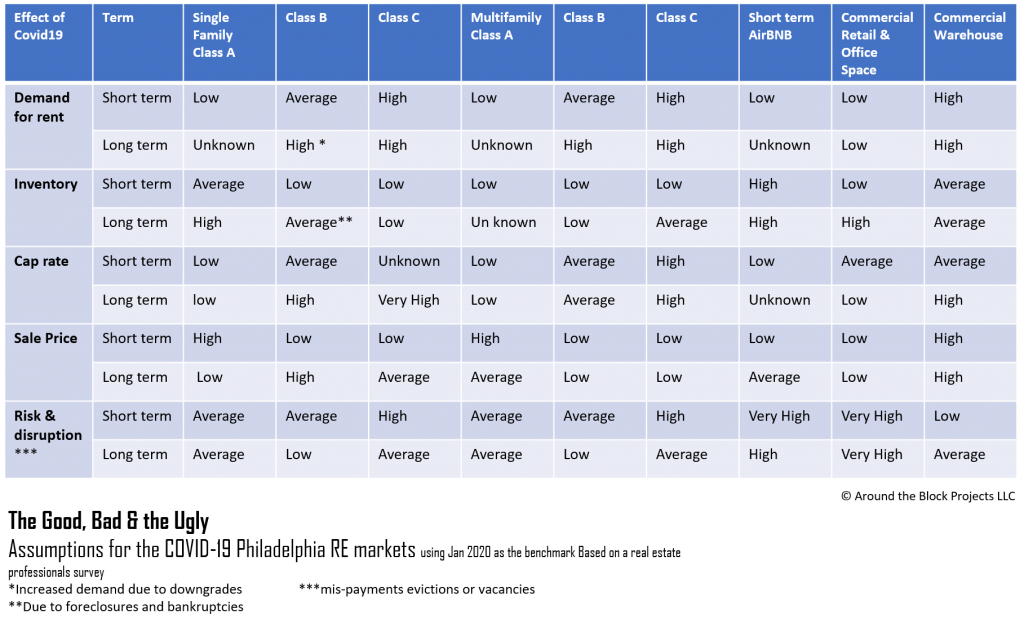

Experts believe that the long-term outlook for the rental market is bright. However, the level of immediate disruption in the market varies considerably depending on the market sector of the property. To analyze how each segment will fare the crisis, we created this table which we call, “The Good, The Bad & The Ugly Analysis”. It is based on the Delphi Method for decision making described previously, which special thanks to Clint Eastwood for inspiration. You can duplicate it for any market in which you invest.

The above analysis is an example of how you can make educated forecasts for different rental market segments. We did this for the Philadelphia market where we are very active and connected. We surveyed the short term and long-term effects of the crisis by leveraging the “Wisdom of the Crowd”. It’s yet another important reason to stay connected to other professionals and local market resources such as local news, community Facebook groups and in times of COVID-19, virtual meetings. We check local news of the communities in which we are invested on a regular basis both during the crisis as well as in “normal” times.

In this analysis, there is a strong case to be optimistic about ‘B’ neighborhoods where it appears, they will offer both good ROI and stability. Lease renewal rates were strong in B neighborhoods even before the crisis. Class “B” properties will likely fare better than more expensive “A” properties or less expensive Class “C” areas that may be more susceptible to job loss and reduced income among tenants. In C and D neighborhoods some renters will “double up” and join with others to share rent if they can’t afford it. We may see a trend of young adults who had already ventured out on their own, moving back in with their parents in the near term. The underlying positive long-term rental trends in Philadelphia should bounce back after the crises. In addition, the above table makes a good case for diversification. Investing in various neighborhood classes and products will help hedge against the unknown.

The single-family rental business may be a long term winner in B and C neighborhoods, as we could also see increasing demand germinating from a shift toward larger units that better accommodate work from home (allowing more space for a home office). With the sudden and vast move to telecommuting brought on by the COVID-19 stay at home orders, some of the crisis mode changes may end up sticking and could increase the demand for larger rental homes in suburbs of metropolitan markets. We already begin seeing people setting a space in their current homes for quiet, clean video conferencing. It would not surprise us to see new technologies and products hit the market soon such as the “home green screen” or rental properties with features like a soundproof room with acoustic insulation and solid core doors for your Zoom conferences — imagine if you will see this ad.

The above analysis is an example of how you can make educated forecasts for different rental market segments. We did this for the Philadelphia market where we are very active and connected. We surveyed the short term and long-term effects of the crisis by leveraging the “Wisdom of the Crowd”. It’s yet another important reason to stay connected to other professionals and local market resources such as local news, community Facebook groups and in times of COVID-19, virtual meetings. We check local news of the communities in which we are invested on a regular basis both during the crisis as well as in “normal” times.

In this analysis, there is a strong case to be optimistic about ‘B’ neighborhoods where it appears, they will offer both good ROI and stability. Lease renewal rates were strong in B neighborhoods even before the crisis. Class “B” properties will likely fare better than more expensive “A” properties or less expensive Class “C” areas that may be more susceptible to job loss and reduced income among tenants. In C and D neighborhoods some renters will “double up” and join with others to share rent if they can’t afford it. We may see a trend of young adults who had already ventured out on their own, moving back in with their parents in the near term. The underlying positive long-term rental trends in Philadelphia should bounce back after the crises. In addition, the above table makes a good case for diversification. Investing in various neighborhood classes and products will help hedge against the unknown.

The single-family rental business may be a long term winner in B and C neighborhoods, as we could also see increasing demand germinating from a shift toward larger units that better accommodate work from home (allowing more space for a home office). With the sudden and vast move to telecommuting brought on by the COVID-19 stay at home orders, some of the crisis mode changes may end up sticking and could increase the demand for larger rental homes in suburbs of metropolitan markets. We already begin seeing people setting a space in their current homes for quiet, clean video conferencing. It would not surprise us to see new technologies and products hit the market soon such as the “home green screen” or rental properties with features like a soundproof room with acoustic insulation and solid core doors for your Zoom conferences — imagine if you will see this ad.

Try applying this ad-hoc, “Good, Bad & Ugly” analyses to your own market, segments and specific niche.

To read more, download our free eBook Get this FREE eBook Now!

From Crisis to Growth. How to Survive and Thrive in Real Estate During a Crisis.

Try applying this ad-hoc, “Good, Bad & Ugly” analyses to your own market, segments and specific niche.

To read more, download our free eBook Get this FREE eBook Now!

From Crisis to Growth. How to Survive and Thrive in Real Estate During a Crisis.

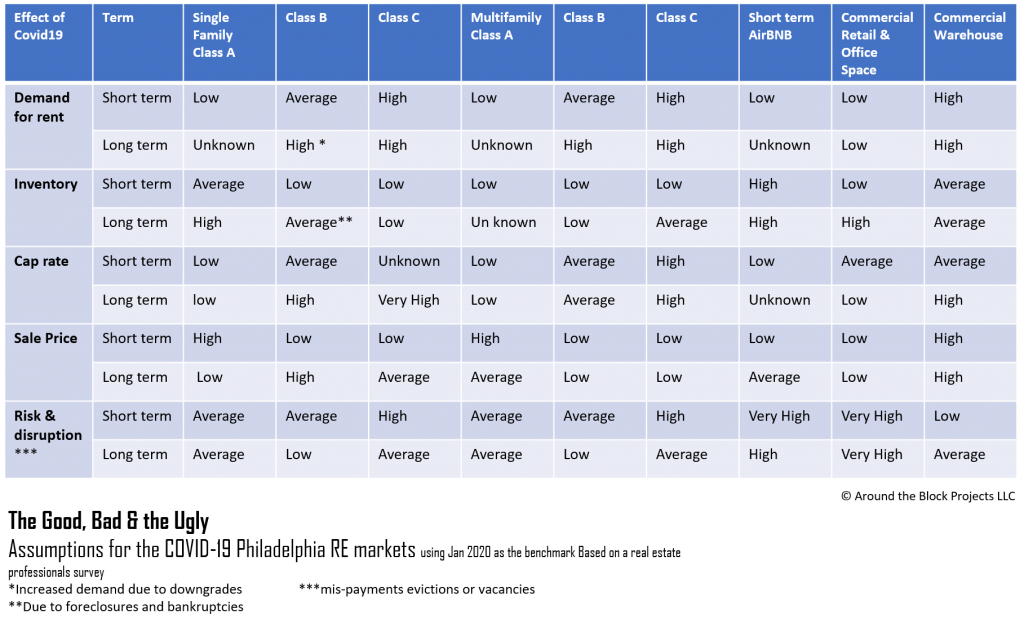

The above analysis is an example of how you can make educated forecasts for different rental market segments. We did this for the Philadelphia market where we are very active and connected. We surveyed the short term and long-term effects of the crisis by leveraging the “Wisdom of the Crowd”. It’s yet another important reason to stay connected to other professionals and local market resources such as local news, community Facebook groups and in times of COVID-19, virtual meetings. We check local news of the communities in which we are invested on a regular basis both during the crisis as well as in “normal” times.

In this analysis, there is a strong case to be optimistic about ‘B’ neighborhoods where it appears, they will offer both good ROI and stability. Lease renewal rates were strong in B neighborhoods even before the crisis. Class “B” properties will likely fare better than more expensive “A” properties or less expensive Class “C” areas that may be more susceptible to job loss and reduced income among tenants. In C and D neighborhoods some renters will “double up” and join with others to share rent if they can’t afford it. We may see a trend of young adults who had already ventured out on their own, moving back in with their parents in the near term. The underlying positive long-term rental trends in Philadelphia should bounce back after the crises. In addition, the above table makes a good case for diversification. Investing in various neighborhood classes and products will help hedge against the unknown.

The single-family rental business may be a long term winner in B and C neighborhoods, as we could also see increasing demand germinating from a shift toward larger units that better accommodate work from home (allowing more space for a home office). With the sudden and vast move to telecommuting brought on by the COVID-19 stay at home orders, some of the crisis mode changes may end up sticking and could increase the demand for larger rental homes in suburbs of metropolitan markets. We already begin seeing people setting a space in their current homes for quiet, clean video conferencing. It would not surprise us to see new technologies and products hit the market soon such as the “home green screen” or rental properties with features like a soundproof room with acoustic insulation and solid core doors for your Zoom conferences — imagine if you will see this ad.

The above analysis is an example of how you can make educated forecasts for different rental market segments. We did this for the Philadelphia market where we are very active and connected. We surveyed the short term and long-term effects of the crisis by leveraging the “Wisdom of the Crowd”. It’s yet another important reason to stay connected to other professionals and local market resources such as local news, community Facebook groups and in times of COVID-19, virtual meetings. We check local news of the communities in which we are invested on a regular basis both during the crisis as well as in “normal” times.

In this analysis, there is a strong case to be optimistic about ‘B’ neighborhoods where it appears, they will offer both good ROI and stability. Lease renewal rates were strong in B neighborhoods even before the crisis. Class “B” properties will likely fare better than more expensive “A” properties or less expensive Class “C” areas that may be more susceptible to job loss and reduced income among tenants. In C and D neighborhoods some renters will “double up” and join with others to share rent if they can’t afford it. We may see a trend of young adults who had already ventured out on their own, moving back in with their parents in the near term. The underlying positive long-term rental trends in Philadelphia should bounce back after the crises. In addition, the above table makes a good case for diversification. Investing in various neighborhood classes and products will help hedge against the unknown.

The single-family rental business may be a long term winner in B and C neighborhoods, as we could also see increasing demand germinating from a shift toward larger units that better accommodate work from home (allowing more space for a home office). With the sudden and vast move to telecommuting brought on by the COVID-19 stay at home orders, some of the crisis mode changes may end up sticking and could increase the demand for larger rental homes in suburbs of metropolitan markets. We already begin seeing people setting a space in their current homes for quiet, clean video conferencing. It would not surprise us to see new technologies and products hit the market soon such as the “home green screen” or rental properties with features like a soundproof room with acoustic insulation and solid core doors for your Zoom conferences — imagine if you will see this ad.

Try applying this ad-hoc, “Good, Bad & Ugly” analyses to your own market, segments and specific niche.

To read more, download our free eBook Get this FREE eBook Now!

From Crisis to Growth. How to Survive and Thrive in Real Estate During a Crisis.

Try applying this ad-hoc, “Good, Bad & Ugly” analyses to your own market, segments and specific niche.

To read more, download our free eBook Get this FREE eBook Now!

From Crisis to Growth. How to Survive and Thrive in Real Estate During a Crisis.