When I was a young boy, we went on a family trip to the Old City of Jerusalem. When we came to the market, my mother got all excited about some kind of mat that the seller wanted 110 shekels for. Through my hazy memory, I recall the process of negotiation between my father and the vendor. At first, they were almost laughing a little, but soon I started feeling tension in the air and my father said, “That’s it, we’re going. Who needs that kind of rag for the house, anyway?” I will also never forget that immediately after we started walking away, the seller chased after us and said, “Okay, 60 shekels, and that’s my final price!” And then after that, I remember smiles, handshakes, and the “rag” stuffed into a plastic shopping bag.

Every once in a while, I need to remind investors that the real estate market above all else is a market. Even the American real estate market, with all its elaborate transactions and rituals, is no different in its essence from that market of my childhood in the Old City of Jerusalem. As investors, we have to consider negotiation strategy. It’s best if this strategy is multi-dimensional and takes into account, among other things, the state of the existing market, future predictions, that condition of the property, and your opponent’s selling strategy—and by “opponent,” I mean the seller. But one dimension that investors tend to make the mistake of ignoring is the dimension of “time on market.” That’s where the irrational poker game begins, according to Professor Dan Arieli, author of the book Predictably Irrational, and unlike in Game Theory, this is actually a game of minds and recognizing the rules of the game offers us a big advantage.

If the seller is going into the market at a suitable price for the property with good market conditions, he’s in a position of strength, while the investor is in a weaker position. However, in the event that the seller has made a mistake in sales strategy, it’s possible that he could drift into a spiral of sinking prices along with the following common mistakes:

- The Mistake:

Price too high entering the market. If the seller enters a calm market or unwisely raises the price relative to the market and requests that the agent maximize their selling price, overestimating the property’s value, they could encounter a situation where the property receives little attention from interested potential buyers.

The Opportunity:

An investor who identifies a property with potential with an overly complacent seller should step away from the property at this stage and let the seller “dry out” a little. However, if sellers are private individuals with a family, it’s possible that they’re selling only after they’ve committed to purchasing a new home. That presents an opportunity for aggressive negotiation. The same is true when we’re talking about investors who think they’re going to get the property for a steal—it may be possible to tempt them with a price that will cut down the waiting time for the money.

- The Mistake:

Panic. Sellers can enter a panic situation after a few weeks with no movement and no purchase offers and lower the prices in this state of hysteria.

The Opportunity:

It’s a good idea to monitor promising properties for any sign of a price reduction. The moment we identify a situation of hysterical price-reduction, we move fast. Of course, we still have to make sure that the price decrease doesn’t stem from some type of objective or technical problem with the property.

- The Mistake:

Zigzag entering and leaving the market. Sometimes, the zigzag continues for years and comes about from the need to take care of problems or a lack of agreement between spouses. Sellers who zigzag harm themselves and drive away buyers and investors.

The Opportunity:

Take advantage of the lack of confidence that this zigzagging projects to make an aggressive offer that will possibly break the market.

- The Mistake:

Staying in the market over an extended time period without changing the price.

The Opportunity:

Almost every seller has a psychological breaking point. Where is that exact point on the timeline? It’s tough to know. We need to take into consideration the competition in the market and the overall trend, the condition of the property and then guess the psychological state of the sellers based on dry facts, who they are and what they are, their behavior in the past, and overall interest in the property. Presenting a suitable offer with the right timing could well make them “break.” Of course, it’s also important to consider that other investors are likely playing the same game, and they, too, have a breaking point that will tip the scales, usually one that involves round numbers of time and money. Therefore, we should look for the less-round numbers (for example—47 days, with a price drop of 5.37%).

- The Mistake:

Winterphobia. Sellers sometimes get frantic as winter approaches, and may even start feeling the stress by the start of autumn—making them ripe for an offer.

The Opportunity:

Carrying out purchases in fall or early winter for properties that were listed in the summer. Sometimes, there could be delays in renovation or sellers’ mistakes making it possible to take advantage.

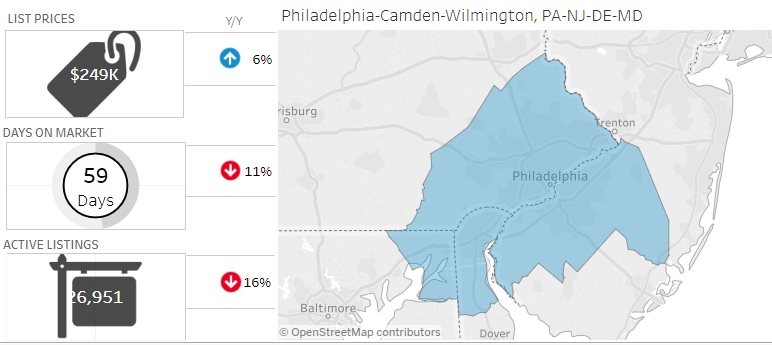

In analyzing the details of time on market, we have to take into consideration the average time to sale in the area. The current hot market today along with the technological changes and the flood of apps on the market have shortened the average timetable and also highlight properties that have been on the market for an extended period. However, as investors actively seeking opportunities, we absolutely can’t ignore the opportunities we could find waiting for us in these hidden treasure troves.

Leave a Reply

You must be logged in to post a comment.