Mike, who works in high-tech, came to us “on the rebound.” He’d previously invested in global real estate and even invested in Philadelphia through a well-known turnkey company. However, Mike was looking for an opportunity that would provide him with excellent income and full transparency.

After defining goals, strategy, and risk level (buy & hold), we started a meticulous search of the existing inventory using various forms of data analysis. In the end, we highlighted three possibilities on the map. We arranged for foot tours and hit the road.

At the end of a week, Mike received two recommendations from us for promising investments for houses in need of massive renovation. Mike chose a property in a particularly tough neighborhood of East Germantown, which is just beginning the process of change and gentrification.

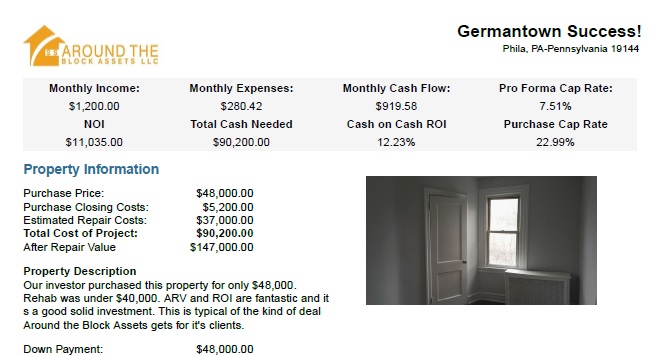

The numbers: Mike bought the property for $48,000 directly from the seller. Total costs including renovation, closing costs, as well as the cost of our service, came to $90,000.

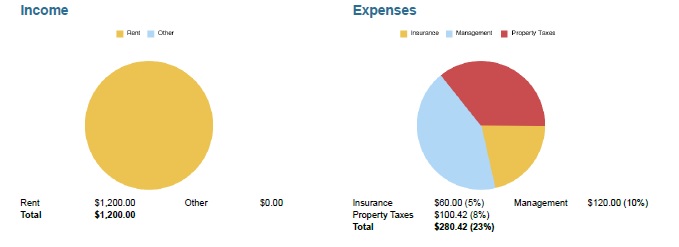

The house was put on the market and rented to a tenant with a two-year lease for $1,200 per month.

The entire process, from start to rental took about 5 months.

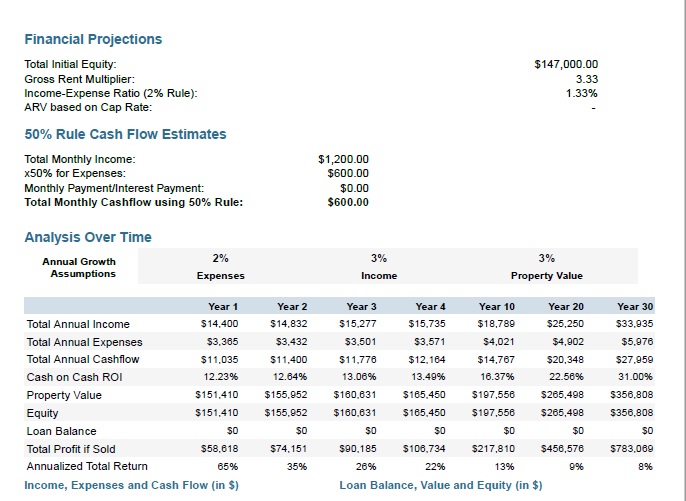

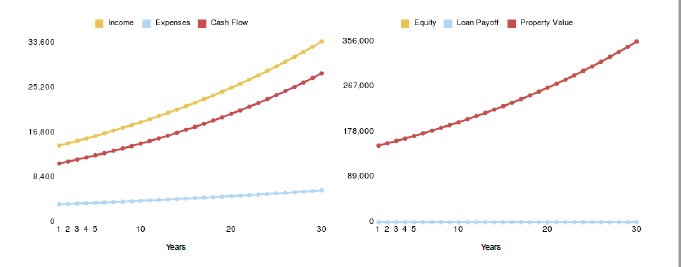

The bonus: a significant increase in value. Checking comps that we tested for similar houses purchased in the immediate area led us to estimate that the value of the house today is about $147,000. An increase of more than 50% over such a short period is an extreme example, and it may be worthwhile for Mike to consider liquidation and selling the property in the near future.

Economic analysis: