There are a few questions we’re often asked by investors who are interested in U.S. real-estate. I’d like to go over them thoroughly because behind the questions is concealed a little “switch” that every investor has make in his or her mind.

The first question sometimes comes after we call a particular property to an investor’s attention: “How’s the house, nice?” This question often comes with another one: “Would I want to live in it?”

The answer to the first question is almost always – no. Absolutely not.

The second question that we get a lot is, “Are we going to have to install appliances like central air conditioning, a dryer, or a dishwasher?” For this question, the answer is: it depends. I’ll explain why in a minute.

But first, let’s look at a few reasons you might want to invest in affordable rental housing.

Yields

On the surface, it may seem much more tempting to buy a luxury home, spacious and wonderful, in a great neighborhood… but the nature of things is that the opportunities for higher yields are actually rarely found in luxury homes. To buy but with a moderate monthly rent. In most cases, the monthly yields on high-end homes will be significantly lower than you would get from affordable single-family homes. (The numbers are different with multi-family projects, in particular in projects for which the property is built from the foundations.) Many tenants, in particular families with moderate income or lower, young people, and students, who can’t afford to buy a house or can’t get financing for a house as a result of their low credit, will agree to spend a significant portion of their monthly income on housing expenses. These tenants, especially in attractive areas of the city, will rent a house that meets very basic standards. of course, we don’t recommend investing in order to take advantage of tenants, or to turn into slumlords, but rather, to invest in houses that offer a reasonable quality of life without harming yields.

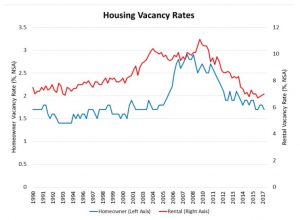

Lack of New Projects

Most new building projects are targeted at initiatives to build luxury apartments. The current Republican administration has almost completely stopped the flow of funds to new affordable residential projects, projects which traditionally rely on government funding. The lack of affordable housing, especially in reasonable blue-collar working neighborhoods, is perceptible and results in a lower home vacancy rate. All of this, in turn, creates a rise in rental rates and a growth in yields.

Widening Gaps

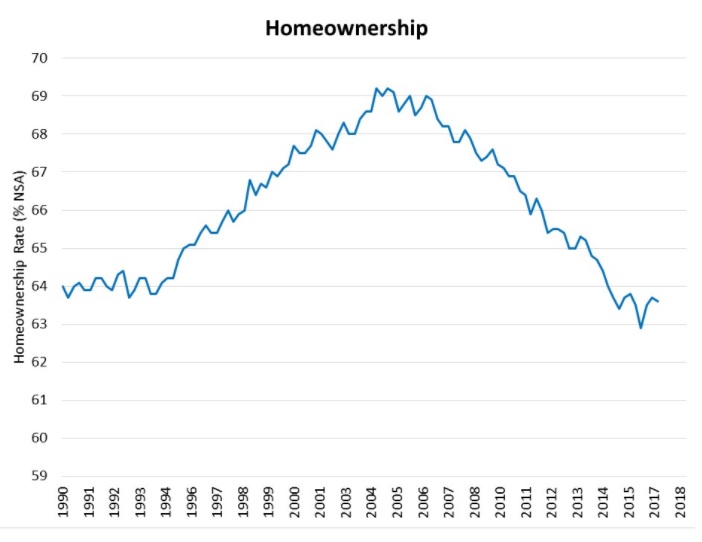

Even though unemployment in the U.S. is going down, the average salary hasn’t gone up. Macro level analysis points to widening gaps between rich and poor and a downward movement in the status of the middle-class. This trend will continue to increase the demand for affordable housing in the years to come.

Crisis-Resistant Investment

It’s just a matter of time until the next financial crisis—that’s the nature of economic cycles. In crisis years, demand for affordable housing goes up and prices generally resist decreases. Sometimes, the growth in demand actually creates a rise in prices relative to luxury homes and in particular luxury apartments, the demand for which decreases in crisis years—driving down prices of luxury apartments.

Now that I’ve clarified why I’m still a believer in investing in affordable housing, it’s time to talk about that switch I mentioned. When specifying what type of property we want to invest in, we have to turn off the switch that’s trying to locate the best houses from an esthetic perspective, and quite searching for the most in-demand communities. Affordable housing also doesn’t have to be in distressed areas, but I want to emphasize—hand to my heart—that most of us wouldn’t live in those areas that are considered particularly “tough” and obviously, not in houses with standards that the average investor isn’t used to. I tend to find the golden mean with the best profits by investing in a middle-class neighborhood in Philadelphia or in neighborhoods that are undergoing renewal. We have to consider the fact that renting out a property in these neighborhoods requires inspection and careful consideration of tenants, a process that could take time and requires patience, however, it’s almost always worth it in the long run.

I wouldn’t recommend investing in accessorizing the property with items that won’t be included in the monthly rental income. For example, installing a central air-conditioning system could cost $5,000 but only raise the rent by about $50 per month. On the face of it, this seems like it wouldn’t be worth it. However, for certain affordable houses or apartments in more attractive neighborhoods, where the competition demands that the home be air conditioned, then I would recommend investing in the installation of an air-conditioning system as part of the overall investment.

Ultimately, as with all real-estate investment, investing in affordable housing in the U.S. isn’t completely free of risks, and perhaps presents its own unique challenges. However, with the help of inspections, familiarity, and insightful decision-making in the field, there’s no doubt that the foreseeable future, investing in affordable housing in the U.S. represents an excellent investment opportunity.

Leave a Reply

You must be logged in to post a comment.